Benefits of Enterprise Application Integration for Business

What are the benefits of Enterprise Application Integration for Business? In this article, we’ll discuss how financial software can benefit from integration with other applications, a unique approach to developing financial software, and ways to integrate financial software with other applications. Read on for more information! Alternatively, read our article on Owlab Group’s unique approach to developing financial software. If you’re ready to take the next step, get in touch with us today!

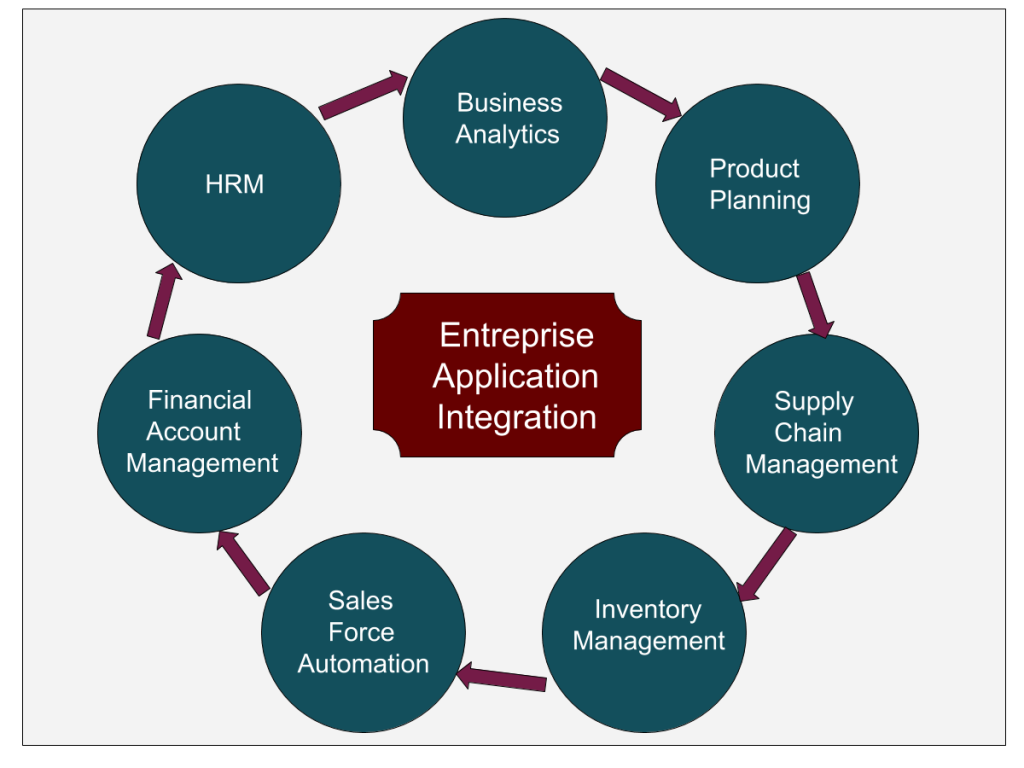

Enterprise Application Integration for Business

The benefits of enterprise application integration (EAI) go beyond efficiency. This technology will increase control, communication, and overall efficiency. It will help you respond quickly to changing market trends, reputation management issues, and other business facets. It will also streamline the operability of many applications. It is beneficial to both business and employees, and can improve individual performance. If you’ve been considering EAI, consider these key benefits.

First of all, enterprise application integration makes data collection and management easier. By making data available to all departments at once, employees won’t need to spend hours looking for information or storing data in multiple places. It will also reduce redundancy and chaos in paperwork. This makes your employees’ job easier, as well as yours. And while integrating applications is a complex process, it can be easily automated by using open source software.

Another major benefit is the fact that it streamlines communication. With a unified information system, your employees and customers will never be in the dark about how important the information is. By integrating different applications, you’ll be able to create a single, easy-to-use data store and streamlining business processes. Enterprise application integration also helps you develop new applications and integrate them across your business. It can make it easier to manage your data and compete more effectively against other companies.

Unique approach to financial software development

The financial software development industry has evolved considerably over the years, and there are several methods to ensure the success of such a project. These methodologies include the use of software development services (SaaS) and custom application development. Financial software development can be challenging, but the payoff is often well worth the effort. Here are some of the ways to make the process as smooth as possible. First, consider the needs of your customers. What types of financial services do you need?

Financial institutions need software that is secure, reliable, easy to use, and has no errors. Security is paramount, as core banking systems handle personal information. In addition, the system must be quick and reliable. The unique approach to financial software development is a crucial factor for success. Here are the four main components of an efficient financial software development process:

Fintech companies should understand the nuances of financial regulation and software security. A qualified team will be familiar with these details. A company that specializes in this area of software development should be able to provide a comprehensive quality assurance plan from the start. After all, your clients’ data is at stake! After all, no one wants to risk the security of their data. As a result, they should choose a partner with expertise and experience in the financial software development industry. There more information.

Ways to integrate financial software with other applications

MPulse is one example of a financial application that can be integrated with MPulse. It assumes that new purchase requisitions and inventory items originate in MPulse, but some businesses enter records directly into their financial applications. Whether or not your business relies on MPulse for these processes, an integration with MPulse can still be beneficial. These integrations provide reporting capabilities.

Most enterprises have bank accounts and want to protect them. Money is something that needs to be carefully managed, but the old adage “If you love it, don’t throw it out” doesn’t apply to financial applications. By integrating these apps with other applications, your company’s bank statement will remain high. Listed below are some ways to integrate financial software with other applications:

Sync related records back and forth. Integrate MPulse and your financial application by syncing the data between the two applications. It’s important to note that not all fields have to be synchronized back and forth. For instance, some clients don’t want critical vendor information overwritten. Therefore, a MPulse-to-accounting system sync might be enough. However, a single-way sync can still function properly.