TD Ameritrade Review

This TD Ameritrade Review will cover the pros and cons of this US-based stockbroker. You’ll learn about its six types of accounts, no inactivity fee, and free 60-day trial. We’ll also talk about the mobile app. You’ll discover that the web platform isn’t intuitive when using a horizontal screen, with the tabs taking up the majority of space. The mobile app also isn’t the most attractive, either.

TD Ameritrade is a US-based stockbroker

TD Ameritrade is a well-known US-based stockbroker with several advantages. Among other things, it offers a diverse range of account types, including managed portfolios, retirement, education, and specialty accounts. For investors who prefer more personalized service, TD Ameritrade also offers 24/5 extended hours trading, a feature that is not common among discount brokerages. In addition, you can also opt for Roth, traditional, or Rollover IRAs.

TD Ameritrade has a wide range of educational materials, including a daily market commentary and analysis. You can filter these by your level of knowledge, as well as the type of media that you prefer to use. The Thinkorswim stock scanner is available for customizing your trades. Moreover, the Market Edge package provides detailed technical analysis. Website https://usforexbrokers.com/reviews/td-ameritrade/ also has a live broadcast of the market from 8 a.m. to 5 p.m. Eastern. There is no other online broker that offers live market broadcasting.

It offers six types of accounts

TD Ameritrade is a reputable broker with a large network of brokerage offices in the United States. Whether you’re new to the markets or a seasoned investor, they can help you make smart investments. The brokerage firm has over 175 offices nationwide, so no matter where you live, you can easily open an account. You can use your social security number to access your account, and they have around-the-clock customer service.

TD Ameritrade offers six types to suit your investing style. Its Personalized Portfolio account is best for investors who prefer to invest for the long-term. With a Personalized Portfolio, you’ll work with a senior financial consultant to customize a portfolio based on your investing goals. This account is easy to access through a personalized dashboard, and it has tax loss harvesting capabilities.

It charges no inactivity fee

TD Ameritrade does not charge an inactivity fee for its brokerage accounts, IRAs, or Thinkorswim platform. You can also invest in stocks, futures, and options without incurring any fees. If you choose to invest in stocks or futures, you should be aware of the risks involved. Investing involves risks including the loss of your principal amount. Therefore, you should carefully review the fees and commissions before opening a trading account.

TD Ameritrade has low commissions and inactivity fees. Its fees are typically low and can be calculated by dividing the average stock price by the NBBO. There are no annual or inactivity fees, either. You can also invest through e-wallets. However, you must note that the company charges fees for using e-mail and text messages. The fees vary based on your account type.

It offers a free 60-day trial

If you’re unsure whether TD Ameritrade is the right online brokerage for your trading needs, a free 60-day trial is a great way to test its services. TD Ameritrade’s paperMoney virtual trading simulator provides up to $100,000 in practice money and uses the broker’s thinkorswim trading platform. The software can be used by both registered customers and non-customers alike, and the simulator is customizable.

In addition to providing virtual accounts with virtual margin and IRA accounts, TD Ameritrade also offers desktop, mobile, and Linux/Unix native platforms. For iPhone and Android users, there are TD Ameritrade apps that provide real-time market data and customizable, interactive charts. You can even stream CNBC live. This is one of the most comprehensive mobile trading platforms, and you should definitely take advantage of it.

It offers a mobile app

If you are looking for a new brokerage, you should consider TD Ameritrade. Its low commissions and fees make it an excellent choice for novice traders. The company offers mobile trading apps and a variety of research resources. TD Ameritrade is also rated Best in Class by a number of sources, including the Financial Times and Barron’s. It also has excellent customer service.

This platform is user-friendly and aimed at investors of all sizes. The sign-up process is easy and painless and new accounts are created in a matter of minutes. TD Ameritrade also offers custodial and retirement accounts. It also offers a mobile app and a desktop version. The company has over 200 instructional videos and publications. Regardless of your level of experience, you are sure to find an educational resource that works for you.

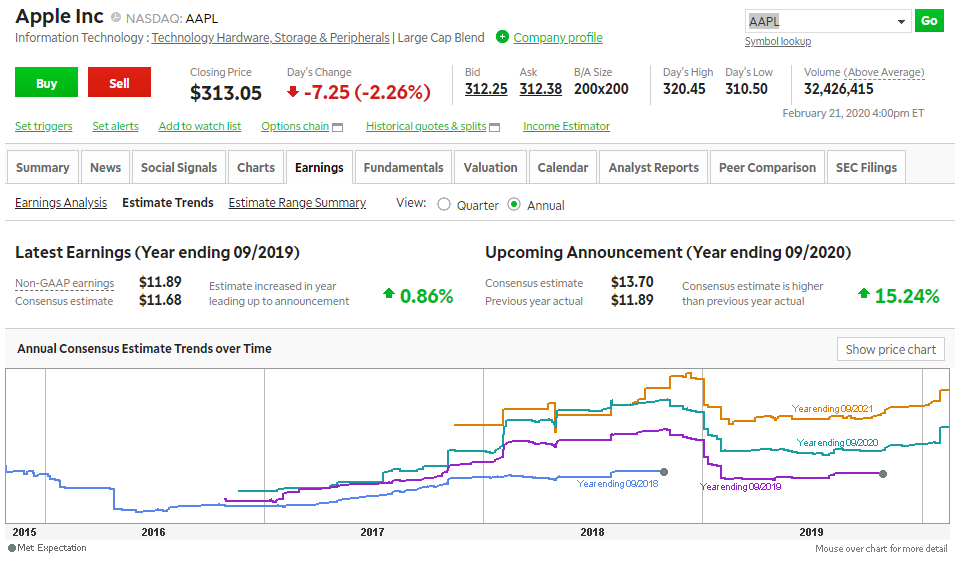

It offers research tools

If you’re looking for a brokerage that provides a comprehensive set of research tools and educational materials, look no further than TD Ameritrade. In addition to providing daily market commentary, this company’s content covers everything from savings and retirement to general finance and trader education. They also publish a quarterly magazine, thinkorswim, that contains articles from oanda vs forex com leading financial experts. A TD Ameritrade review of their research tools and resources will help you determine which platform is best suited for your needs.

If you’re looking for an online broker with low fees, TD Ameritrade has several options to meet your needs. You can choose from a variety of account types, trading platforms, and investment options. The brokerage is also very user-friendly, with a number of help center buttons, educational materials, and an Ask Ted feature that can answer questions. You can even get help from a TD Ameritrade customer support representative.